As the world's largest exporter of liquefied natural gas (LNG), Qatar seeks to dominate the industry by increasing its output and optimize its market competition strategy, specifically to Asia's nascent market.

In the past five years, the country had prioritized price as its critical competitive driver instead of market share. However, the global shift in interest to renewable energy has emphasized its strategic approach to compete with its main competitors: the U.S. and Australia.

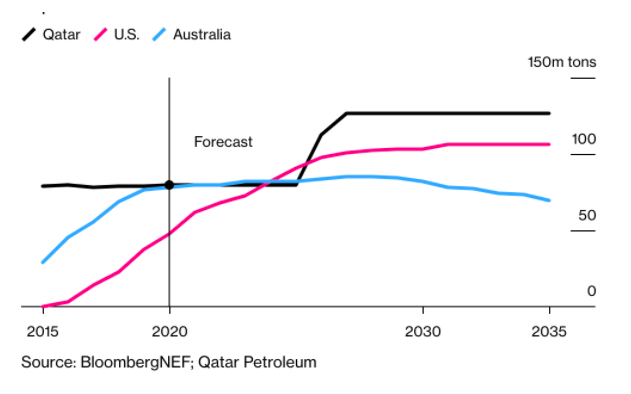

Over the recent months, the competition among the three countries has been unruly; with the U.S. came close to overtaking Qatar's monthly export value in April, the country is planning its way to retain the solid reputation of the natural gas exporter.

The North Field Expansion Project

Since the 1990s, Qatar's LNG industry mainly relies on the development of international companies, such as Royal Dutch Shell, ExxonMobil, and Total, through lucrative long-term supply relationships.

However, the gulf country plans to detach itself from dependency and expand its LNG outreach by partnering with Chinese state firms in Qatar's North Field expansion project.

The country's state energy company, Qatar Petroleum (QP), has also stated its plan to sell around USD 10 billion of bonds to support its expansion through the North Field project and plan to set predatory pricing for LNG worldwide. The country benefits from a low production cost due to the abundance state of its resources.

The North Field expansion project would allow Qatar to solidified its reputation as the largest LNG exporter, providing over 110 million tonnes per annum or a 40 percent increase of gas by 2026.

The output increase would fulfill demands from countries seeking to tackle climate change by reducing coal usage. LNG becomes one of the preferable alternatives as it could effectively replace coal in heating, electricity generation and reduce emissions, albeit still not carbon-free.

Producing Low-Carbon Natural Gas

Qatar has also expressed its interest in reducing carbon emissions from natural gas liquefaction by around 25% below competitors' operations worldwide.

The project would capture carbon dioxide and integrate a sequestration system with the Qatari CCS Scheme in Ras Laffan, providing the most considerable capacity in the LNG industry after fully operating.

The integration to CCS supports Qatar's sustainability pledge for its upstream and downstream operations in January this year.

Dominating the Evergrowing Market

China takes about 8.3 percent of the world's LNG demand and expects to grow by 8.6 percent this year, becoming the world's biggest LNG importer with over 354.2 billion cubic meters per annum.

The country's state firm, Sinopec, has signed two long-term deals with Qatar to set up an office in Doha and secure supply for their fast-growing market.

Aside from the uprising demands from China, the global LNG demand has also increased since 2012 and will continue to perform a steady annual growth rate of 3 to 5 percent from 2021 to 2025.

The number stems from the fact that renewable energy projects are still deemed too expensive for countries to power their needs thoroughly.

The North Field expansion project is currently still being reviewed. Therefore, the project still has possibilities to pose more potential growth that would boost the nation's LNG production capacity and take over the global natural gas demand through its flexible cost, environmental integrity, and lucrative supply.